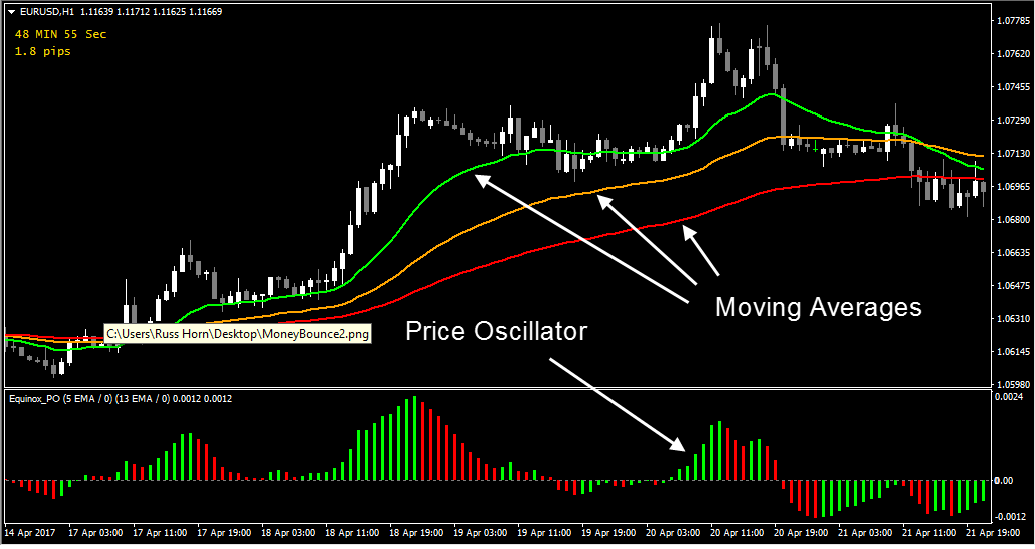

Forex Money Bounce Strategy is a trend trading strategy that takes advantage of the trend momentum. Russ Horn is giving his second trading system as a gift. You can download Forex Money Bounce Strategy 18 page PDF, indicators and template as a gift. You can take a look at a screenshot of this Forex Money Bounce Strategy below.

In the above screenshot you can see how the Forex Money Bounce system looks. As said above this is a trend trading system. It comprises of 3 moving averages and a price oscillator. The 3 moving averages are 20 EMA, 50 EMA and the 100 EMA. When the 50 EMA is above the 20 EMA and the 100 EMA is above the 50 EMA, market is in a strong uptrend. Similarly when 20 EMA is above 50 EMA and 50 EMA is above 100 EMA, it means the downtrend in the market is very strong. So just by looking at the system screenshot you should have idea of the trend in the market.

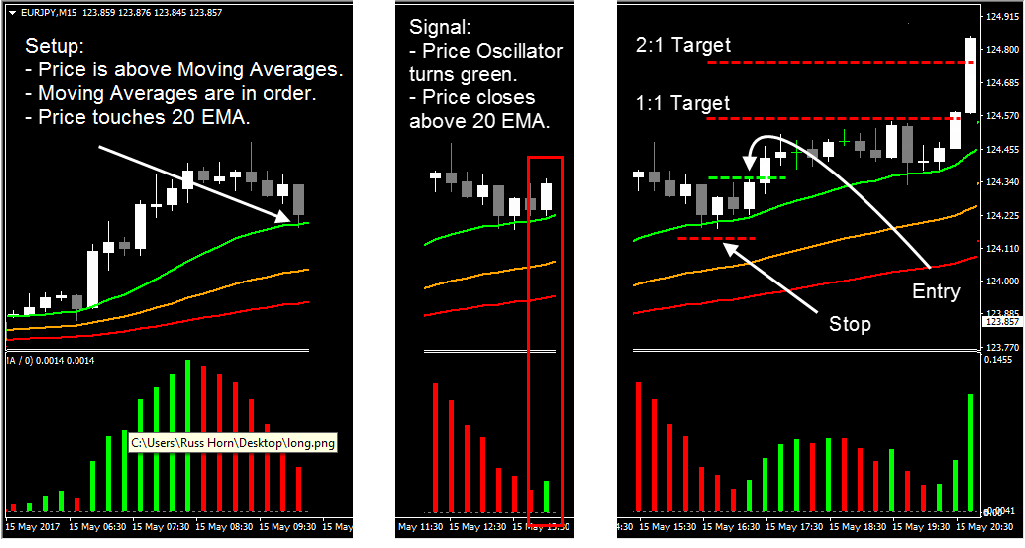

Now we need to find opportunities to trade in the direction of the trend. Price oscillator is just a histogram of the difference of 2 EMAs, 5 EMA and 13 EMA just like the MACD histogram. When the price oscillator is green, it is a long signal. Similarly when the price oscillator is red, it is a short signal. Below is a screenshot that explains the long trade rules.

In the above screenshot, you can see the three EMAs they are in an ascending order. So this is the first precondition for the long trade. 50 EMA is above 20 EMA and 100 EMA is above 50 EMA. The second precondition for a long trade as shown in the above screenshot is that price should retrace and touch 20 EMA and bounce from it. We will enter into a long trade when the price oscillator turns green. You will place the stop loss below the most recent swing low as shown in the above screenshot. Take profit should be the same as stop loss. Everything is explained in great detail by Russ Horn in his 18 page Forex Money Bounce Strategy PDF.

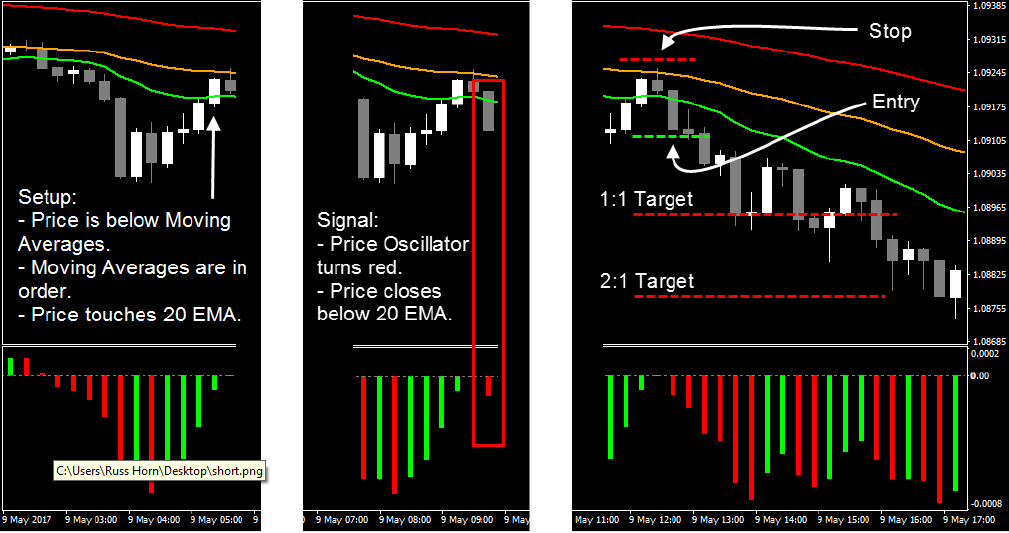

In the above screenshot you can see the short trade rules.For a short trade, the three EMAs should be in a descending order. 100 EMA should be above 50 EMA which should be above 20 EMA. Now as for the long trade, price should go above and touch the 20 EMA and bounce from it below. You will enter into a short trade when the price oscillator turns red. Everything is explained in detail by Russ Horn in his 18 page PDF. You should download it and go through it.

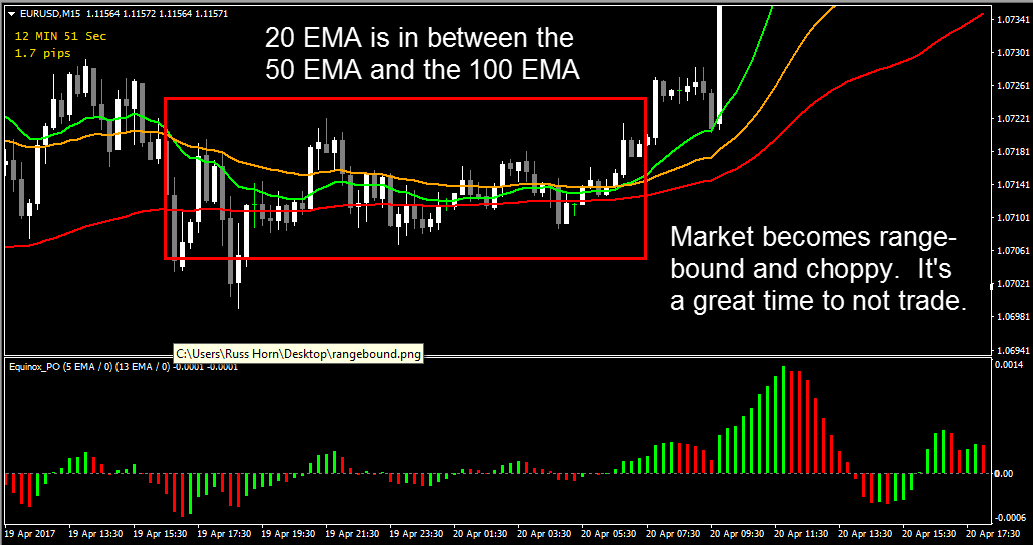

Now in the above screenshot you can see the market ranging. This is the time when you should avoid opening a trade. Russ Horn gave his Forex Profit Ribbon System a few days ago as part of the launch of his main product Forex Equinox. You should download both these systems and test them on the practice account and see how good they are.

In the next few days, Russ Horn will open the doors to his Forex Equinox system. This is his main system. You can win a complimentary copy of Forex Equinox by leaving a comment that stands out from the crowd when you download the two free systems that he is giving as gifts. Make sure you read the other comments first. This is going to give you an idea as to what type of comment you should make.

Risk management is the most important thing in trading whether you trade forex, stocks, options etc. Don’t try to take too much risk. Reward to Risk is an important parameter that you should closely watch. On average try to have a Reward/Risk of 2:1 for each trade. This will ensure that you make 2 times what you lose. So losing a few trades wont wipe out your account. This is what I do. I look for trades that make 100-200 pips with a small 10-20 pips stop loss. Suppose you can make 100 pips with a small stop loss of 10 pips. This gives you a Reward/Risk of 10:1 which is excellent. If you can achieve this R/R, you can make tremendous pips. So focus on R/R and risk management. Don’t try to open. trades that have big stop losses. Look for opportunities that give you small risk trades that can make 100-200 pips.

Another thing that you should do is always use Limit Orders. This way you can enter the market at a much better price. Using limit orders will also free you from watching the charts all the time. Forex trading and binary options trading have many things in common. Both use the same technical analysis. This is what I do. I combine and trade forex and binary options together. Instead of scalping for a few pips, I trade 5 minute binary options while in forex I look for swing trades that can make 100-200 pips per trade with a small stop loss of 10-20 pips. Swing trade can take a few days to develop so you should be patient. If you are impatient then trade 1 minute or 5 minute forex binary options.